The Bitcoin ‘Exchange Stablecoins Ratio’ has increased recently, according to on-chain data. What it could entail for asset prices. Bitcoin Exchange Stablecoins Ratio Exceeds 5. In a CryptoQuant Quicktake post, an analyst explained that the Bitcoin Exchange Stablecoins Ratio has increased with the cryptocurrency’s price gain. The Exchange Stablecoins Ratio is an on-chain indicator that tracks the BTC Exchange Reserves to stablecoins ratio. Of course, the “Exchange Reserve” is the entire quantity of the asset in all centralized exchange wallets.

BTC’s Exchange Reserve is rising relative to stablecoins when the indicator rises. However, its decline suggests stables are dominating these platforms. Both asset types’ Exchange Reserves varied from the sector. Exchange Reserve can be used to evaluate market selling pressure for Bitcoin and other volatile assets. These platforms receive coins from holders who desire to trade them. Also true with stablecoins, although as their price is ‘stable’ by design, investor selling has no effect.

If stablecoins are swapped for tokens like BTC, it affects the volatile market, even though it doesn’t affect their price. Stable purchases naturally boost asset prices. Thus, stablecoin Exchange Reserves indicate sector buying pressure.

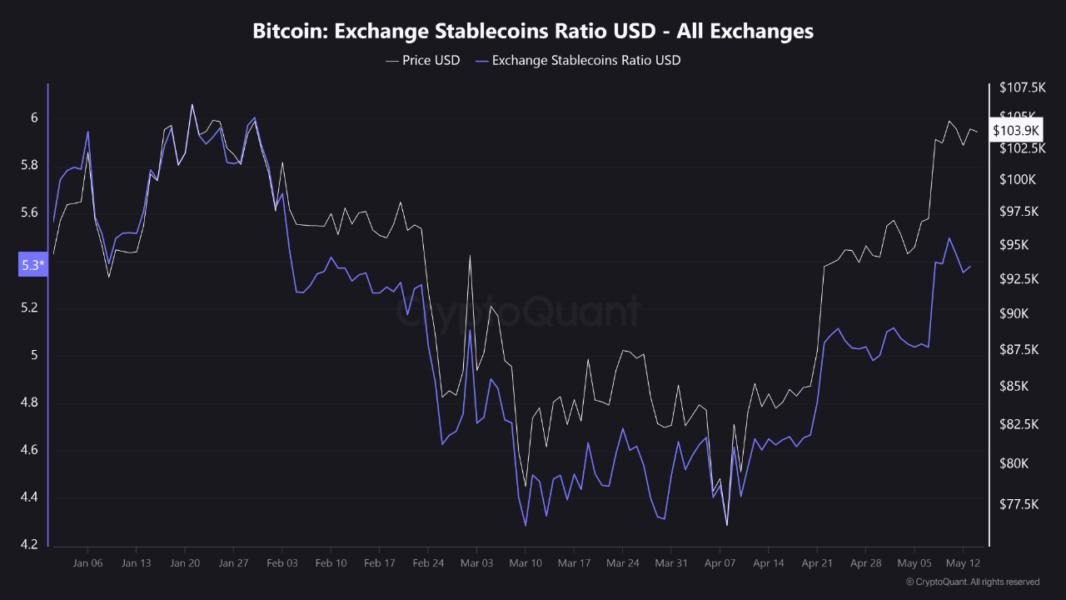

The Bitcoin Exchange Stablecoins Ratio trend over the previous few months is shown above: The Bitcoin Exchange Stablecoins Ratio has been rising, indicating that investors are depositing BTC quicker than stablecoins. As of 5.3, the BTC Exchange Reserve is more than five times that of the stablecoin. This may be bad for the cryptocurrency because it suggests that sector selling pressure surpasses stable buying pressure.

Similar to the late-January peak near 6.1, which preceded a sharp decline, traders may be preparing to sell BTC for cash. Whether the Bitcoin rise can continue despite this tendency is unknown. Bitcoin has traded sideways for days, hovering around $103,500.