On-chain data indicates that significant Bitcoin investors have persisted in their purchasing activities as the coin’s price nears its all-time high (ATH). Recent trends indicate that Bitcoin investors holding between 10 and 10,000 BTC have increased their holdings. In a recent update on X, the on-chain analytics firm Santiment has discussed the current trend regarding the supply held by Bitcoin’s significant investors: those possessing between 10 and 10,000 BTC.

At the prevailing exchange rate, this range translates to $1 million at the lower end and $1 billion at the upper end. Therefore, the sole investors capable of qualifying for it would be those possessing significant holdings. Generally, the influence of any entity in the market increases with the amount of supply they control, thus the holders within this range occupy a significant position in the ecosystem. These investors are commonly referred to as the sharks and whales.

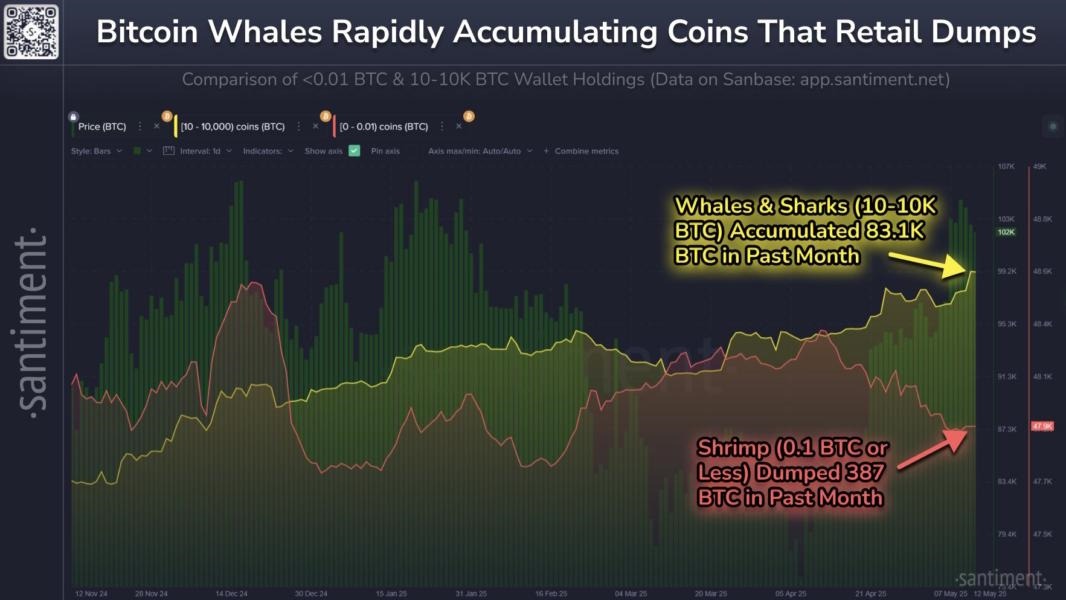

Above is the chart shared by the analytics firm, which illustrates the trend in the Supply Distribution for the sharks and whales, an indicator that monitors the combined supply held by members of these cohorts: The above graph illustrates that the Supply Distribution among Bitcoin sharks and whales has recently increased, indicating that these significant investors are augmenting their holdings. In more precise terms, investors holding between 10 and 10,000 BTC have accumulated approximately 83,100 tokens in their wallets during the last month. This accumulation has not occurred in a uniform fashion; indeed, these investors reduced their supply for a time earlier in the month.

The selling from the cohorts occurred after BTC’s recovery beyond $97,000, suggesting that the underlying motive was likely profit-taking. The chart clearly indicates that this selloff led to a pullback in the cryptocurrency market. In the recent resurgence of bullish momentum, large investors have once more engaged in Bitcoin accumulation, significantly exceeding their holdings from the previous peak. Thus far, the groups have exhibited no indications of profit-taking, which can inherently be a bullish signal for the sustainability of the rally.

In the same chart, Santiment has also included the data for the Supply Distribution of investors holding less than 0.1 BTC. Interestingly, these investors have been divesting while the sharks and whales have engaged in accumulation. This may suggest that the shrimps anticipate a peak in the near future. In light of the significant investments from major players, the analytics firm observes, “it may be a matter of time until Bitcoin’s coveted $110K all-time high level is breached, particularly after the U.S. & China tariff pause.”

As of this moment, Bitcoin is valued at approximately $103,800, reflecting an increase of 11% over the past week.