Recently, Bitcoin achieved a new all-time high of $111,980 on the Binance crypto exchange, surpassing its previous all-time high of $108,786 recorded in January 2025. However, this rally lacks a critical component that has traditionally driven enduring bull markets – the involvement of retail investors. Bitcoin’s recent rally appears to be lacking substantial retail interest. A recent CryptoQuant Quicktake post by contributor burakkesmeci indicates that retail activity amid the ongoing BTC rally is significantly muted. This phenomenon is atypical, given that new all-time highs usually attract considerable interest from retail investors.

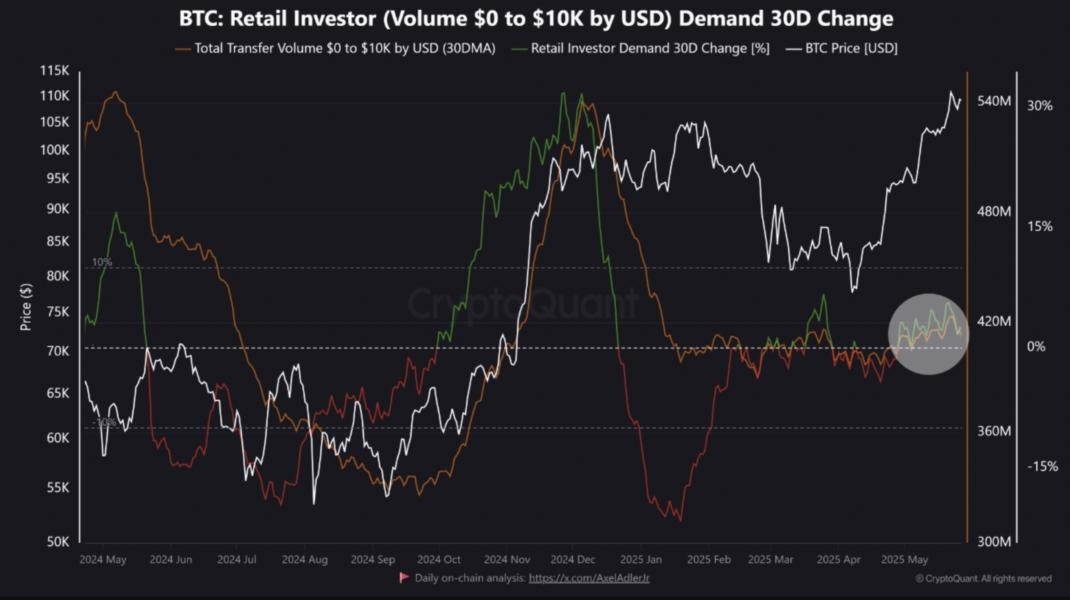

The analyst presented the subsequent chart that underscores this trend. The data indicates that the transfer volume of BTC within the $0 to $10,000 range, which serves as an indicator of retail demand, has experienced only a modest increase, despite the rise in prices. Despite the steady ascent of Bitcoin’s price (white line), the 30-day percentage change in retail demand (green line) has exhibited minimal variation. This suggests that the prevailing momentum is predominantly fueled by institutional investors, while retail participants have yet to engage significantly.

Recent developments lend credence to this perspective. For instance, the institutional heavyweight Strategy continues to augment its BTC holdings, now approaching the 600,000 BTC threshold. Historical patterns, especially those observed during the 2020–2021 bull run, indicate that although institutional accumulation frequently initiates a rally, it is predominantly retail investors who provide the momentum necessary for it to reach sustained peaks. The present rally could falter in the absence of substantial retail volume.

In conclusion, the CryptoQuant analyst indicated that for BTC to sustain its price expansion, a definitive increase in retail participation is essential. They stated: We are observing preliminary indications of activity; however, it has not yet reached the stage of a breakout. If retail volume increases in the coming weeks, new all-time highs may merely represent the initial phase. Recent flows from crypto exchanges indicate that BTC reserves are depleting rapidly. For instance, the US-based exchange Coinbase recently experienced a new outflow of 7,883 BTC, prompting speculation that institutions are accumulating the leading digital asset in anticipation of its next upward movement.

In a similar vein, technical indicators suggest that BTC may reach another all-time high in the near future. The leading cryptocurrency by market capitalization has recently emerged from a double bottom pattern on the hourly chart, igniting optimism for a potential ascent toward the $112,000 threshold. In the interim, the behavior of whales has exhibited a degree of variability. Although short-term investors have realized gains, long-term holders continue to display resilience, exhibiting little inclination to liquidate their positions. Nonetheless, the medium-term outlook for BTC appears highly favorable, with certain analysts forecasting a price target of $200,000 by the conclusion of 2025. At press time, BTC is valued at $108,802, reflecting a decline of 0.6% over the last 24 hours.