Analyst Indicates Bitcoin is Displaying Pre-Rally Signals Observed Prior to Significant Breakouts in 2024. A recent CryptoQuant Quicktake post suggests that Bitcoin (BTC) may be on the verge of its next significant movement. Contributor Crypto Dan noted that BTC is presently establishing an accumulation pattern akin to those seen in 2024 – patterns that preceded substantial rallies.

Bitcoin has experienced a surge exceeding 13% in the past week, indicating a resurgence of optimism within the digital assets market. This momentum arises in the context of diminishing global tariff-related tensions, which had earlier posed challenges for risk-on assets. The ascent of Bitcoin has been accompanied by a significant expansion in the total cryptocurrency market capitalization, which has surged from around $2.5 trillion on April 8 to exceed $3.1 trillion at the present moment.

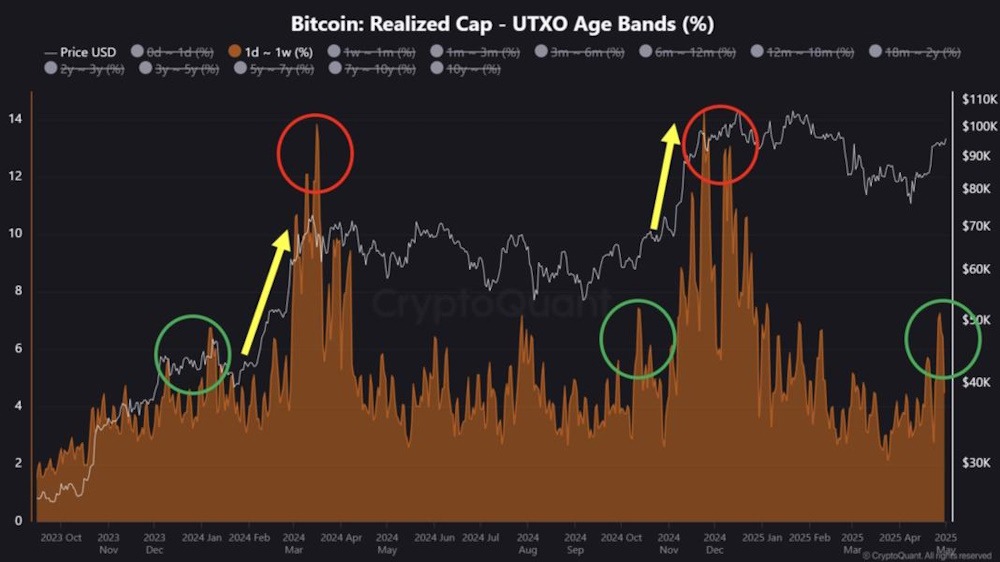

The evolving technical structure of BTC contributes to the positive sentiment. A recent analysis by a contributor from CryptoQuant highlighted that BTC is exhibiting an accumulation pattern, which historically has been a precursor to significant price rallies in 2024. The contributor presented the accompanying chart, indicating that BTC’s present trajectory seems to reflect patterns observed in January and October 2024. In both instances, BTC experienced a notable uptrend driven by a marked rise in the activity of short-term holders.

The term “short-term holders” denotes investors who generally retain BTC for a duration ranging from one day to one week. Historically, a rapid surge in engagement from this cohort has been succeeded by significant price increases, not just in BTC, but also among leading altcoins. The analyst articulated: This indicator has consistently preceded significant price increases, establishing itself as a dependable signal of accumulation. If this trend persists in the near term, Bitcoin could potentially surpass $100K and enter a robust upward trajectory.

In the interim, notable cryptocurrency analyst Ali Martinez has pinpointed $97,530 as the forthcoming significant resistance threshold. Martinez highlighted that exceeding this price threshold could pave the way for Bitcoin to attain new all-time highs (ATH). Despite increasing optimism, not all indicators align to suggest an immediate breakout. Some analysts express caution regarding the obstacles that Bitcoin continues to encounter. It is important to note that the 30-day Demand Momentum continues to reside in negative territory, indicating that the recent bullish sentiment may not yet be fully sustainable.

Furthermore, on-chain metrics indicate that a genuinely parabolic movement may require additional time to materialize. CryptoQuant contributor Carmelo Aleman noted that although BTC reserves on exchanges are persistently decreasing, which reflects the confidence of long-term holders, the current conditions may not suffice to instigate a comprehensive supply shock. Nonetheless, a noteworthy development is the recent sharp rebound in Bitcoin’s Apparent Demand, which may suggest the initial phases of a trend reversal. As of the latest update, Bitcoin is valued at $96,370, reflecting a 1.9% increase in the past 24 hours.