Bitcoin’s price dynamics remain a focal point as it momentarily exceeded $87,000 in today’s trading session, reflecting a significant 3.3% uptick over the preceding 24 hours. Although it has recently retraced to approximately $86,815 as of this writing, the asset’s steady recovery since last week seems to be establishing a basis for possible upward momentum. Analysts are currently observing technical indicators and on-chain metrics as market sentiment shifts towards a short-term bullish perspective.

On-chain data platform CryptoQuant has identified significant changes in market dynamics, offering insights into funding rates, investor positioning, and levels of psychological resistance. While there have been notable advancements, certain investor segments continue to grapple with unrealized losses, particularly those holding positions for the short term.

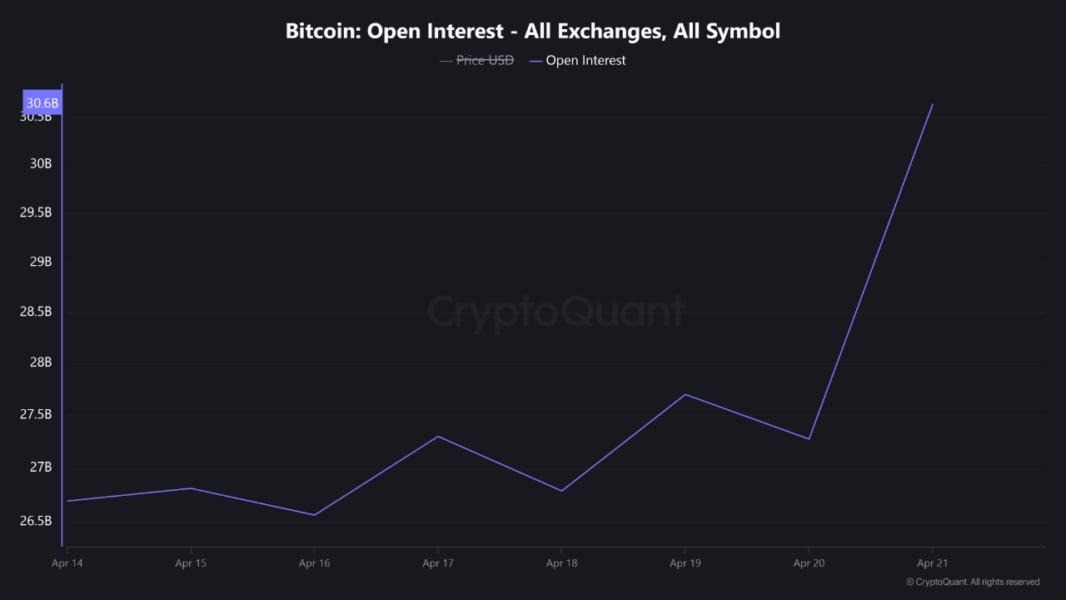

A recent analysis presented by CryptoQuant contributor EgyHash highlights various indicators that imply Bitcoin may be on the verge of another upward movement. The analyst highlights a notable increase of $6 billion in open interest within derivatives markets over the last fortnight.

The total open interest in Bitcoin across all exchanges.

Open interest quantifies the aggregate value of outstanding futures contracts, with its expansion generally indicating heightened participation or confidence regarding the anticipated trajectory of price movements. This metric, alongside an increase in funding rates, suggests a growing interest in long positions among traders. Another important indicator, exchange inflows, which measure the volume of Bitcoin being transferred to centralized exchanges, has experienced a significant decline during this timeframe.

The inflow of Bitcoin across all exchanges.

A decline in the volume of coins transferred to exchanges may suggest a diminished willingness to sell, given that holders generally deposit assets with the intention of liquidating them. The decline in exchange inflow has been viewed as a reduction in selling pressure, which may contribute to a more stable price environment in the near term. The aggregation of these on-chain metrics suggests a market poised for a potential continuation of its prevailing trend, contingent upon the stability of external variables. Recent entrants into the market are experiencing gains, whereas those holding assets for shorter durations are encountering challenges.

Although some indicators suggest a positive outlook, a closer examination of investor segments uncovers varying results. Another analyst from CryptoQuant, Crazzyblockk, highlights that Short-Term Holders (STHs), defined as individuals who acquired BTC in the past six months, are currently experiencing unrealized losses. Their average acquisition price is approximately $91,000, establishing a significant resistance level that could impact future price dynamics. While Bitcoin remains below this threshold, underlying selling pressure may continue, particularly if upward momentum falters. In contrast, recent entrants to the market, characterized as those who have begun investing within the last month, have started to realize gains. The group has achieved a realized gain of 3.73%, indicating a resurgence of confidence that may provide short-term price support.

Nonetheless, the analyst indicates that the prevailing risk zone continues to be in effect until Bitcoin secures a definitive close above the $91,000 threshold. Crazzyblockk articulated: Short-Term Holders will continue to experience losses until Bitcoin surpasses the $91,000 mark. This could maintain underlying selling pressure, particularly if price momentum falters — highlighting the necessity of a clear breakout above the STH realized price to alleviate this burden.