The trend in active addresses may indicate the possibility that the Bitcoin Demand is resuming. On-chain data indicates that the Bitcoin network is presently experiencing an increase in Daily Active Addresses. This analysis explores the potential implications for the price of BTC. Bitcoin active addresses have recently surpassed the 800,000 threshold.

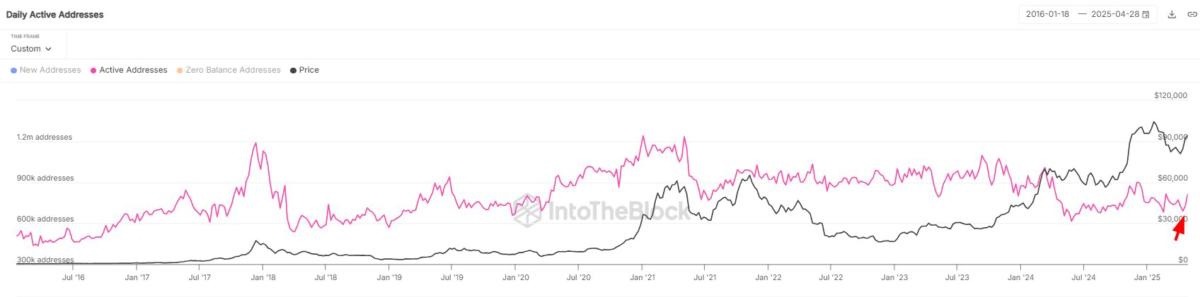

In a recent post on X, the market intelligence platform IntoTheBlock has analyzed the latest trend in the Daily Active Addresses of Bitcoin. The “Daily Active Addresses” serves as an on-chain metric that monitors the aggregate number of BTC addresses engaging in transaction activities on the network on a daily basis. The chart presented by the analytics firm illustrates the trend in Bitcoin Daily Active Addresses over the past decade. The graph illustrates a recent increase in Bitcoin Daily Active Addresses, indicating a rise in user activity on the network. The increase in the indicator follows a notable price rally in the cryptocurrency market.

An increase in the value of this metric indicates a growing number of users becoming active on the blockchain. This trend may indicate a growing interest in the cryptocurrency market. Conversely, the decline in the indicator suggests that investors might be reallocating their focus, as there appears to be a reduced influx of participants engaging with the network.

Historically, the blockchain has exhibited increased activity during periods of volatility, as investors typically engage to realign their positions in these phases. The recent increase in Daily Active Addresses is perhaps not unexpected. Typically, rallies tend to sustain themselves when they capture user attention, as heightened chain activity serves as the essential fuel for maintaining momentum in such movements. Price surges that fail to generate an uptick in the metric typically dissipate in a short period.

Considering the recent surge in Daily Active Addresses, the current recovery rally appears to be on solid ground, provided that this increase in activity genuinely reflects heightened demand from investors. Nonetheless, although there has been a resurgence of activity on the Bitcoin network in recent times, the current value of the indicator, approximately 800,000, remains relatively low in historical context. In the previous year, the Daily Active Addresses reached a peak of 900,000. This value remains significantly below the 1.2 million peak observed during the previous two bull markets in the blockchain sector.

Bitcoin has exhibited a sideways trajectory in recent days, with its price remaining around the $94,800 mark.