Bitcoin has experienced a resurgence, buoyed by a renewed sense of optimism following Donald Trump’s announcement regarding plans to lower tariffs on China. This indicates that the tariff wars that commenced in January 2025 may be approaching a conclusion. Interpreting this as an indicator, Bitcoin whales have resumed their activities once more. To date, they have acquired nearly 20,000 BTC, with BTC exchange outflows reaching levels that have not been observed in more than two years.

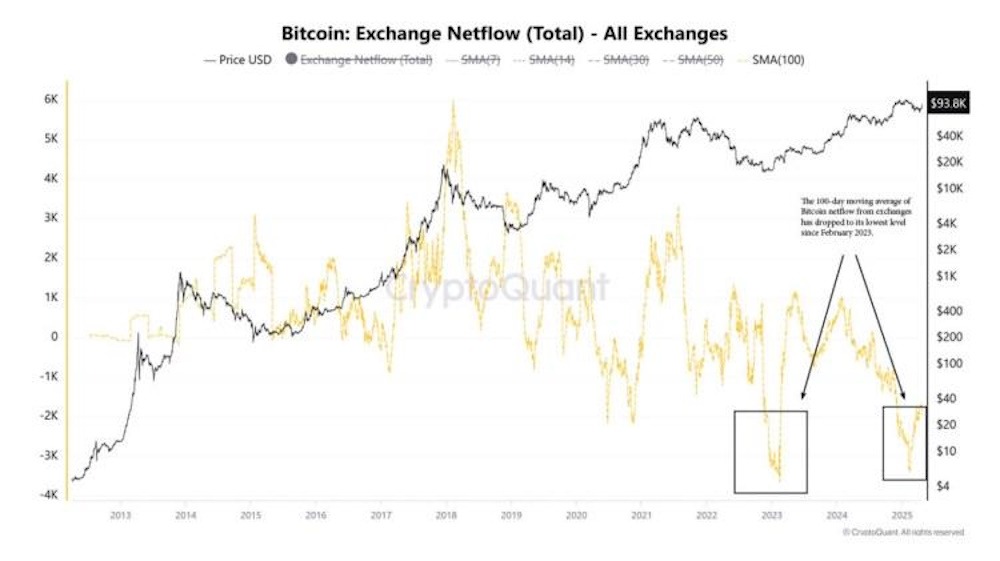

Bitcoin exchange outflows have returned to levels not seen since February 2023. As reported by the on-chain data tracking platform CryptoQuant, there has been a significant outflow of BTC from exchanges, reaching levels not observed in the past two years. This data, derived from a 100-day moving average, indicates that net flows have decreased markedly not only from 2025 and 2024, but also extending back to 2023.

According to CryptoQuant’s data, Bitcoin net flows from all exchanges have experienced a decline of over 50% in the past year. At present, it is positioned at such a low level that the last occurrence of this magnitude was in January 2023, a period when the cryptocurrency market was beginning to recover from the repercussions of the FTX crypto exchange collapse.

Bitcoin net flows. When net flows are this low, it indicates that Bitcoin investors are opting to accumulate rather than liquidate their holdings. It indicates a trend of withdrawals from exchanges into private storage, as investors retain their BTC, expecting higher prices before initiating sales.

“This essentially indicates the highest Bitcoin outflow from exchanges since that date,” CryptoQuant elucidated in the post. “A review of historical patterns suggests that this could imply re-accumulation of assets by investors.” The recent surge in Bitcoin prices appears to be propelled by bullish investors who capitalized on the lower price to amass significant quantities of BTC in a remarkably brief period. Santiment reported on this development, indicating that the 11% Bitcoin price rise may have been influenced by the purchasing activities of these significant investors.

Bitcoin accumulation

The data indicates that investors possessing between 10 and 10,000 BTC engaged in a significant buying activity over the past week. In total, they accumulated an additional 19,255 BTC to their balances within a mere span of seven days. This indicates that whales had recognized the undervaluation of the BTC price and had taken advantage of the opportunity to swiftly secure profits. At the time of writing, the Bitcoin price was trending around $94,578, demonstrating robust resilience from the bulls.